Holiday Shopping Recap 2021: Supply Disruptions, Bracketing Nightmares, and a Very Early Start

If the 2021 holiday shopping season seemed a little “weird,” that’s because it was. After a particularly stressful 2020 holiday season amid Covid-19 lockdown, many consumers expected to have a semi-normal season this year with family gatherings (at least small ones) and gift-giving. Supply chain breakdowns, shipping delays, and the ongoing pandemic—now filled with additional variants and concerns—influenced consumer behavior as well as retailer behavior this year, causing a holiday shopping season quite unlike any year prior.

Auctane, alongside ShipStation, has released a new report with key findings about 2021 holiday shopping trends and consumer expectations, capturing the absurdity of this year’s changes.

Supply Chain Struggles Major Motivator This Holiday Season

Among the major concerns faced by consumers, this year were the ongoing supply chain breakdowns that notably impacted the availability of products. Impacting this fear, consumers can see that big box stores often run out of basics such as:

- Bagels and cream cheese

- Carbonated drinks / soda

- Chicken

- Coffee

- Diapers

- Toilet Paper…

And the list goes on. While consumers struggle to find everyday products in the face of these supply chain disruptions, the availability of holiday gifts is thrown into question, and for good reason. Major ports are essentially in a traffic jam and many buyers are struggling to find Christmas lights and artificial Christmas trees. Gift supplies that are seeing the most disruption include:

- Consumer electronics like TVs, cellphones, and laptops

- Specific kids’ toys

- Game consoles like the PS5

- Jewelry

- Books

- Fashion and accessories (e.g. Michael Kors and Nike due to pandemic-related factory shutdowns)

- Sportswear

- Etc.

Because of these supply chain disruptions, consumers altered their behavior accordingly:

- 62% of consumers started shopping earlier than usual this year.

- 81% would not make an online purchase without an estimated delivery date listed at checkout

- 72% said they would choose to buy something else if their number one gift choice was delayed due to supply chain issues

Did you know? Due to supply chain disruptions and shipping delays, 62% of consumers started shopping for the holidays sooner than usual this year. A thread on supply chain… 🧵

— ShipStation (@ShipStation) December 15, 2021

Shopping Early – Black Friday And Cyber Monday No Longer At The Starting Line

Black Friday and Cyber Monday usually mark the start of the holiday shopping season, but not in 2021. Because consumers were concerned about shipping delays, 57% were not willing to wait for Black Friday deals in order to make a purchase. A whopping 62% of shoppers started their shopping prior to Black Friday this year. This, among fears surrounding rising Covid-19 cases, meant that only 38% of consumers made plans to shop in stores during this year’s Black Friday sales.

It wasn’t all-or-nothing, however—23% of people shopped both online and in-store this Black Friday.

23% of consumers shopped both online and in-store this Black Friday🛒

— ShipStation (@ShipStation) November 30, 2021

Consumers expected to have sizable buffers between gift arrivals and the actual holiday, with most expecting Out of any other category, most people expected to receive purchased gifts at least two weeks before the holiday, weighing in at 33% of respondents surveyed.

Online Or In-Person – Consumers Make Their Preferences Clear

Choosing not to shop in-person at brick-and-mortar stores and shopping malls was not a trend isolated to Black Friday. Online shopping and omnichannel pickup options dominated this year’s trends.

Here’s a breakdown of shipping and pickup trends for the 2021 holiday shopping season:

- 68% of consumers expected to do more online holiday shopping than during 2020

- 63% were more likely to use buy-online-pickup-in-store (BOPIS) this year

- 57% are more likely to use curbside pickup than in 2020

- 47% are more likely to utilize locker pickup

Think online shopping peaked in 2020? Think again. 68% of consumers will do more holiday shopping online this year than they did last year… a thread on consumer shopping preferences🧵

— ShipStation (@ShipStation) December 3, 2021

Returns – Did Retailers Cut Them Too Short?

Because of all of these early shopping trends, many retailers are wondering if they should have considered a different approach to returns this season. While most businesses opt to extend return windows during the holiday season, many are considering that they have not increased that window far enough for 2021. Retail giant Amazon has opened its holiday return window to extend from October 1 until January 31, 2022. Other retailers may yet still look to extend their return windows.

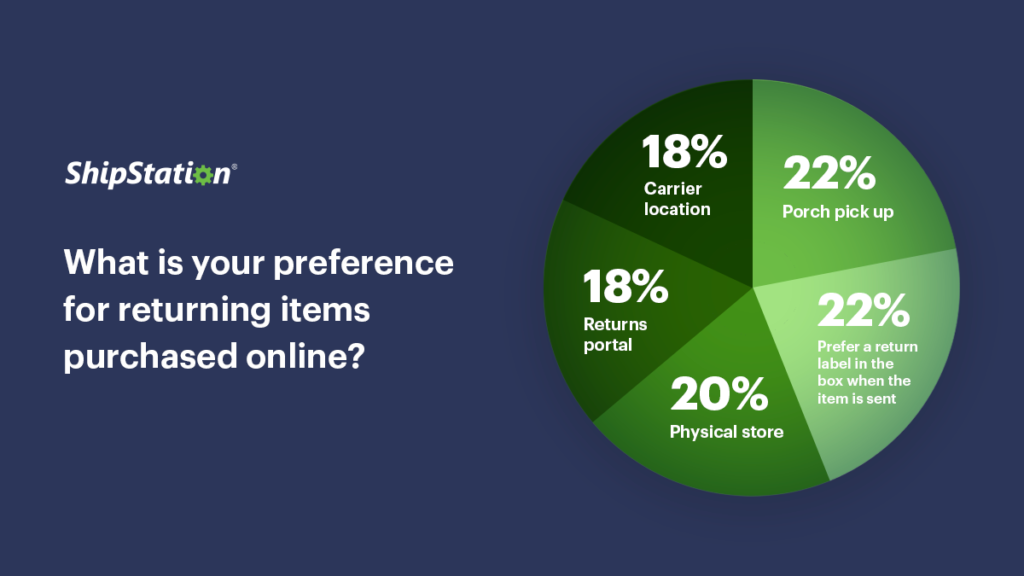

This, however, doesn’t clarify another pressing point—this time coming from consumers—regarding the returns process. Many shoppers don’t agree as it pertains to how to make returns, whether by porch-pickup vs. in-store drop-off return methods.

This could be a problem, considering experts are predicting that returns will reach a record high this year. This brings us back full circle, because that same jump in return rates is expected to contribute to even more supply chain backlogs. According to Optoro, two out of three consumers are expected to return a gift this year.

One major driver of the expected increase in returns is a shopping behavior called “bracketing” wherein consumers buy multiple sizes or colors of an item and then utilize free shipping to return the ones they don’t want. This is a widespread trend—58% of shoppers reported bracketing behaviors, so retailers are bracing for a logistical nightmare reaching into 2022.

2022 Predictions

As we close 2021, the beginning of a new year is a time when online retailers have some time to reflect on trends and how to set their businesses up for even more success.

Free Returns

If there’s one area that continues to frustrate online shoppers, it’s returns. As the ecommerce space continues to evolve in 2022 and beyond, retailers will need to offer flexible returns policies, with more options and ease.

We have been espousing the idea of free returns for years, but many retailers hesitate. This, however, will be the year retailers will really adopt it. They will have to do so if, for no other reason, than that the return can generate a new, profitable sale, so they will want the inventory back. The idea of “keep it” returns likely won’t happen as much this year.

Inventory Visibility

Customer expectations have changed seemingly overnight because of the pandemic. This isn’t a trend. It’s a new reality that has affected the very core, and future, of supply chain operations. Without real-time views into inventory, businesses risk losing customers who want to buy from a retailer who can check stock across multiple locations and provide up-to-the-minute views on what’s available nearby.

Inventory visibility into where stock is, which warehouse it’s in, and the quantity on-hand — accurate up to the minute — will be critical in 2022.

Secondhand Ecommerce

We’re in year two of supply chain issues. Inflation continues to drive clothing prices up. It’s feels safe to say these issues won’t disappear soon. On top of that, sustainability is becoming more important to consumers, and businesses are taking steps to do their part. Shipping can be an extremely wasteful, plastic-filled process.

Concerns about sustainability have led to a boom in secondhand retail and ecommerce companies, such as The RealReal, Poshmark, and thredUp, and this space is poised to continue expanding. As demand for a more sustainable shipping process grows, recycled and biodegradable shipping materials will hopefully become more accessible and affordable for businesses in 2022. Sustainability is not relevant only in shipping materials, but in other shipping logistics like inventory management or the actual physical movement of goods. The carbon footprint of these activities is something to be considered, and the conversation of how to ship things sustainably and affordably will become even more relevant in the next year.

Want to learn more about how the pandemic has impacted ecommerce? ShipStation has published original research and surprising findings in an ebook called The Global Pulse: Ecommerce After COVID-19. Download the full ebook here.